Employee Retention Credit: The impact of Notice 2021-20 on Can Be Fun For Anyone

Tax Tips for Claiming the Employee Retention Credit Can Be Fun For Everyone

What incomes qualify when calculating the retention credit? Wages/compensation, in general, that go through FICA taxes, as well as qualified health expenses qualify when determining the worker retention credit. These should have been paid after March 12, 2020 and receive the credit if paid through Sept. 30, 2021 (Recovery Startup Companies have till Dec.

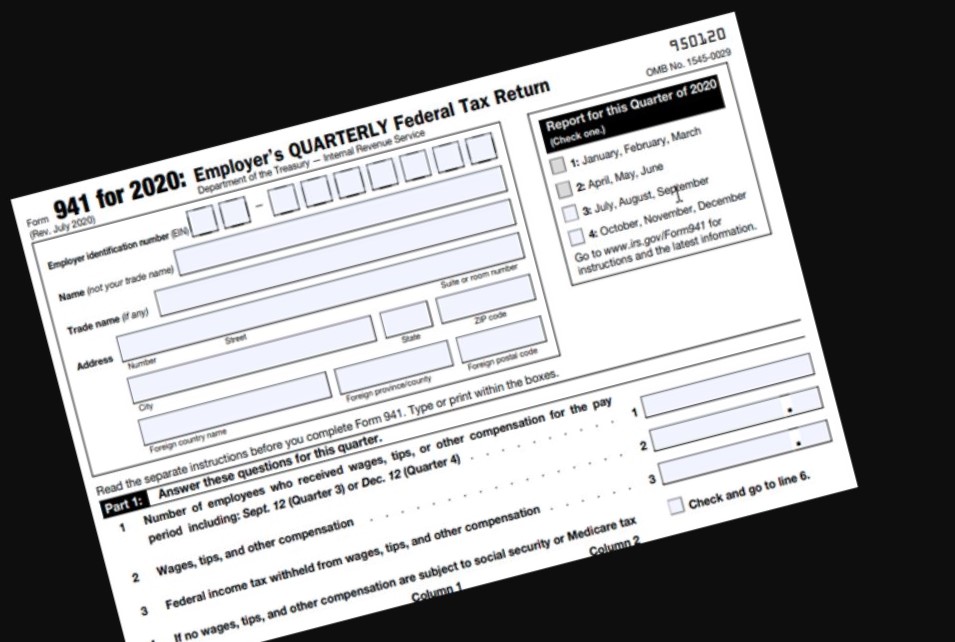

Claiming the Employee Retention Credit for Past Quarters Using Form 941-X - Boutin Jones Inc.

Remember, the credit can just be taken on earnings that are not forgiven or expected to be forgiven under PPP. When determining youtu.be/pZX5sJ7Mc_8 qualified health expenditures, the IRS has numerous ways of computing depending upon situations. Usually, they consist of the employer and employee pretax portion and not any after-tax amounts.

For the functions of the worker retention credit, a full-time worker is specified as one that in any calendar month in 2019 worked at least 30 hours each week or 130 hours in a month (this is the month-to-month equivalent of 30 hours weekly) and the definition based on the employer shared duty provision in the ACA.

A company who started a business throughout 2019 or 2020 determines the variety of full-time employees by taking the sum of the variety of full-time employees in each complete calendar month in 2019 or 2020 in which business operated and divide by that variety of months. An employer who began an organization in 2021 figures out the number of full-time employees by taking the amount of the number of full-time workers in each complete calendar month in 2021 that the organization ran and divides by that number of months.

What is the Non-Refundable Portion of Employee Retention - An Overview

If you are an accounting expert, do not offer your customers with the PPP Forgiveness FTE details. Also, keep in mind that if a client has actually taken and will be forgiven for a PPP loan, they may now be qualified for the worker retention credit on certain salaries. CARES Act 2020 Those who have more than 100 full-time staff members can only use the qualified wages of workers not supplying services due to the fact that of suspension or decline in business.

IRS Employee Retention Credit - Augusta Metro Chamber of Commerce

Generally, employers can only use this credit on workers who are not working. Employers with 100 or fewer full-time workers can utilize all worker earnings those working, as well as at any time paid not being at work with the exception of paid leave supplied under the Families First Coronavirus Response Act.